Wisconsin's best value in small business accounting

Accounting & Bookkeeping Services in Milwaukee & Madison

The cost of our accounting and bookkeeping services varies based on your needs. The industry standard is to pay 1-2% of revenue for internal accounting functions and related support.

Example: if your total annual revenue is $1M, you’re looking at $10,000 to $20,000 per year or a monthly rate of $800 to $1600.

Where your price falls in that range depends on your priorities. Straight bookkeeping (our monthly reporting package) is more in the 1% range.

Your monthly rate would increase if you also needed payroll, bill pay, and sales tax. Other pricing factors include unusually complex books or special requests. That could push you up into the 2% range.

There are exceptions. We have some clients who pay a half percent of revenue, and some who pay more than 3% of revenue, but most fall in the 1-2% range.

You can use the bookkeeping cost estimator on our homepage to get an idea of how much money you’ll save by using our services, compared to the cost of hiring an in-house bookkeeper or accountant.

On this page:

Accounting fees, bookkeeping rates, consulting costs - it's all your money. We offer invaluable services for a reasonable price.

Professional bookkeeping with no surprise costs. Ever.

Billing will be based on a budget we agree upon together ahead of time. We'll discuss monthly and annual budget targets and you'll have plenty of chances to revisit the budget throughout the process.

Our professionals are passionate about helping small and family-owned businesses succeed. We work with small business owners all the time. They can afford our bookkeeping services and so can you. Contact us for a free, no-pressure consult so we can talk real numbers:

How much should a small business pay for accounting services?

Many small business owners pay a part-time or freelance bookkeeper an hourly rate of around $25. Freelance bookkeepers are often former accounting firm employees with limited experience and resources. For an hourly rate of $25 you are not getting the benefits of professional bookkeeping.

At the other end of the spectrum are large bookkeeping firms who charge hourly rate of $150-$200. Small business bookkeeping is an annoyance for big firms, and you won’t get the level of service you deserve.

Our customized bookkeeping price packages give the average small business owner enterprise-level service at a rate they can afford. We’ll work with you to establish an affordable monthly fee for services tailored to your business. Your invoice will reflect the hourly fees of the professionals assigned to work on your account.

You don't have to settle for freelancers or get fleeced by a big firm. Get a free consultation & personalized price quote today.

We look beyond the average cost of bookkeeping services and create a package with the greatest value for YOUR business.

One-time fee for cleaning up your books

For new clients, step one is evaluating your current books and fixing the problems we find. The cost depends on the state of your books when we take them over. Most triage and repair fees fall in the $2,000 to $5000 range, which is spread out over the first 90 days. After cleaning up the books we move to our agreed-upon monthly fee.

How do your rates compare to paying an in-house bookkeeper?

The most important variables are whether you need full-time or part-time bookkeeping, and whether or not your bookkeeper is being hired as an office manager and administrator. The annual salary for full-time bookkeepers who perform other office duties can range from $35,000 to $60,000 plus benefits.

Many entrepreneurs outsource their bookkeeping because of the technical nature of financial accounting. Hiring an individual bookkeeper or using a temporary placement service is common, but turnover can be detrimental to the integrity of financial statements.

Low cost, hourly bookkeepers often do not have the technical expertise to handle more sophisticated issues like sales tax filings and certain audit procedures.

We surveyed college professors and compiled the research to help our clients budget for bookkeeping services:

Starting with the concept of a business model, you should have an idea of what percentage of revenue you can spend on key areas and still make a profit. Our article What should my business model be? explains how to create a business model and determine what percentage of revenue should be spent on bookkeeping.

For corporate businesses, accounting costs are between 1-2%; many have an in-house accounting/bookkeeping team. Their total accounting costs can vary depending on the number of employees on the team, but each full-time salary can be about $55,000.1

According to accounting and finance professors at the University of Wisconsin-Milwaukee, small businesses can spend anywhere from 1-5% of revenue on bookkeeping, with some spending even more.

For small businesses, they are likely to spend a higher percentage of revenue on bookkeeping and financial consulting costs. Starting with 1-2% of revenue is a good first pass.

It’s also important to consider how much you’ll need to spend to clean up your books. Often people come to us after years of neglect.

For example, if a reasonable monthly payment for doing your books is $500, then cleaning up an entire year of neglect could be in the $5000 range.

It’s crucial to consider the time you save by outsourcing your bookkeeping. According to one survey, the majority of small business owners said they spend more than 41 hours on tax preparation each year.2

Say that you spend 20 hours preparing your annual tax return. If you value your (or your employee’s) time at $50 an hour, the total cost of preparing the return would be:

Cost of preparing tax return = $50 x 20 hours = $1,000 per year

Preparing tax returns is only one piece of the puzzle, and valuable time must be spent on other accounting tasks such as payroll, invoicing, bill pay, and reconciling bank accounts.

Additionally, it’s crucial to monitor your financial statements on a monthly basis, giving you a clear picture of where your business stands financially. Spending even 10 hours per month on these items would cost you $500 monthly using the same model above.

Outsourced bookkeeping rates are a worthy investment because it gives your small business a greater chance of success and prosperity. At The Giersch Group, we offer a variety of services in addition to preparing our monthly bookkeeping packages, including business model comparisons and financial statements.

Keeping costs affordable with a better approach to bookkeeping

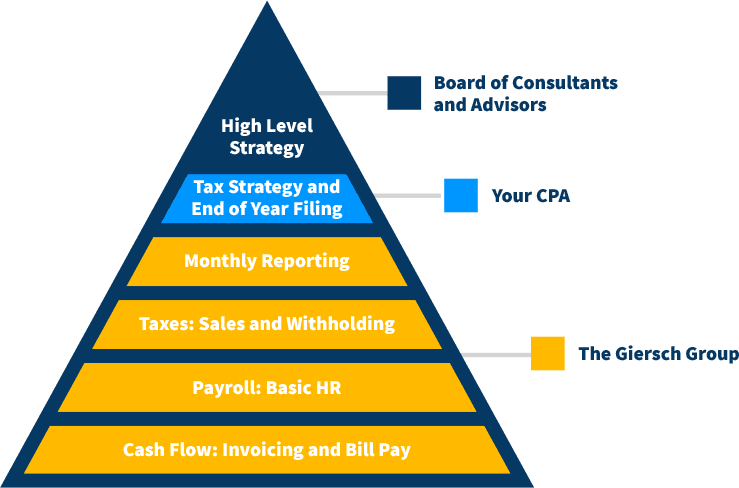

Keeping financial records for a company is a complex process involving many steps. In larger companies, these steps are separated into different roles, and even at times different departments. The benefit of bookkeeping with The Giersch Group is that you get a team approach to your financial system needs for a very reasonable price. The Giersch Group approaches each client with the following team:

Controller: Every client of the Giersch Group is assigned a controller. The controller acts as your own personal account manager. He or she will work with you to make sure that your financials are done correctly and that your monthly report focuses on the areas of greatest concern to you with clear, accurate, and timely reporting. It is the job of the controller to oversee the Giersch Group bookkeepers and solve more complex strategic issues.

Bookkeepers: The Giersch Group bookkeeping services provide full accrual accounting, accurate reporting, and a clear picture of the financial health of your business so you can make better decisions. Schedule your free consultation to find out how our experienced professionals can benefit your business.

Real Testimonials from Giersch Group Customers

Giersch Group bookkeeping rates

Currently, our hourly fees for bookkeeping services are:

Associates

Senior Associates

Client Controllers

Giersch Group business review cost

Giersch Group business reviews can range from $2,500 to $8,000 depending upon the size, complexity and purpose of the review.

Giersch Group business management consulting board services fee

The typical fee for board services is $1000 per month, plus mileage and expenses. This can vary based upon the complexity of the business and the necessary work between meetings.

Family-run business board services pricing

The cost of our next generation board services is $1000 per month, plus mileage and expenses. The monthly fee may vary based on the complexity of the business and work done between meetings.

Bookkeeping services for every business

No matter what industry you work in, the Giersch Group provides the best value in bookkeeping:

Wisconsin bookkeeping and consulting firm with affordable rates

The Giersch Group has offices in Milwaukee, Brookfield, and Madison, Wisconsin. We provide flexible professional services to small businesses and nonprofit organizations throughout southeast Wisconsin including Waukesha, New Berlin, Oak Creek, Muskego, Mequon, Menomonee Falls, Port Washington, Monona, Sun Prairie, Waunakee, Middleton, Cottage Grove, and the surrounding communities.

We believe in providing excellent accounting services at a reasonable price. The cost of our bookkeeping and consulting help ultimately depends on the depth and breadth of service. While bookkeeping and consulting is at the heart of our operating strategy, we also offer payroll processing, tax compliance, accounting software training and virtual CFO services.

Every type of business and nonprofit deserves and benefits from professional accounting support. We'll work with you to establish an affordable rate for services tailored to meet your business needs.

Contact the Giersch Group online to get a free consultation and personalized quote for our services.

References:

- Payscale - https://www.payscale.com/research/US/Job=Corporate_Accountant/Salary

- Accounting Today - https://www.accountingtoday.com/opinion/the-burden-of-accounting-and-taxes-on-small-business

- CFO - http://ww2.cfo.com/operations/2015/05/metric-month-total-cost-finance-function/

- Accounting Today - https://www.accountingtoday.com/opinion/the-burden-of-accounting-and-taxes-on-small-business

Is your freelance or in-house bookkeeper meeting your needs? Our bookkeeping service delivers consistent quality and enterprise-level financial reporting (and never takes a vacation).